Law School Scholarship & Financial Aid Guide: The Negotiator's Playbook

Don't pay sticker price for law school. Master the art of scholarship negotiation with our 2026 guide, featuring email templates and peer-school leverage charts.

The Negotiator's Playbook: Securing Your Full Potential

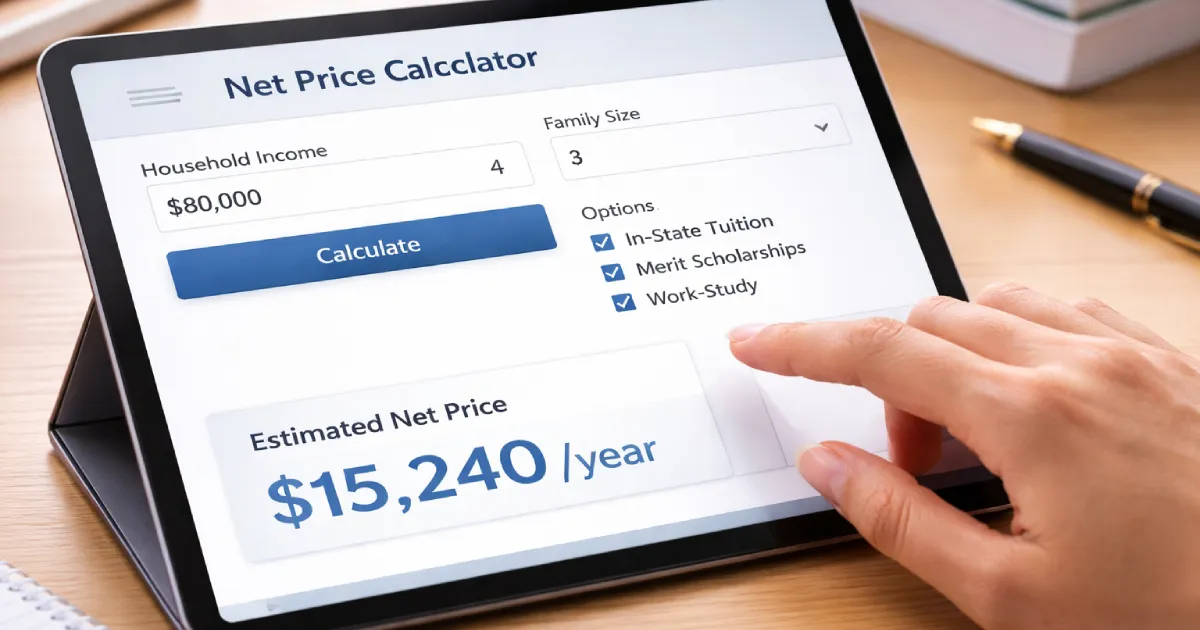

In 2026, the sticker price of a law degree has become a secondary figure. The "Net Price"—the tuition remaining after merit scholarships—is the only number that matters. This guide, written by former T14 financial aid experts, gives you the exact strategy needed to leverage your offers and minimize your six-figure debt.

The Golden Rule

1. The Hierarchy of Law School Money

Merit Scholarships

The most common type of aid. These are "stat-buyer" funds used to recruit students who will raise the school's median GPA or LSAT for ranking purposes.

Need-Based Aid

Historically rare in law school but making a comeback. Requires FAFSA and often the CSS Profile. T3 schools (YHS) are almost exclusively need-based.

External Funds

Niche grants from bar associations or practice-area groups (e.g. Patent Law grants). These require extra work but have much lower competition.

2. Identifying "Generous" Schools

Not all law school budgets are created equal. To see who is actually spending money on students, you must look at the ABA 509 Required Disclosures.

What to Look For:

- % Receiving Aid: If this number is < 60%, the school is "stingy." Aim for schools where 80%+ receive grants.

- 75th Percentile Grant: This shows you the "Full Ride" potential. If the 75th percentile is equal to full tuition, they are actively buying high stats.

The "Upwardly Mobile" Signal

Look for schools whose rank jumped 5-10 spots last year. They are often in "growth mode" and will pay significantly more for students who can help them maintain or increase that momentum.

The Leverage Map: Who Negotiates with Whom?

*Note: Schools generally only negotiate against peer institutions within the same ranking tier or geographic market.

Behind the Scenes: Yield Management

Why do schools negotiate? It's not out of charity—it's business. Law schools are ranked on their "Yield," which is the percentage of admitted students who actually enroll.

If the Director of Admissions thinks a $10,000 increase is the difference between you choosing them or their rival, they will often pay it to protect their stats. You aren't just a student; you are a data point they want to secure.

3. The Art of the Scholarship Negotiation

Gather the Paper Trail

Collect official PDFs of every merit offer. Schools will NOT negotiate based on a "verbal promise" or an email you summarized. They need to see the actual letterhead.

Frame the "Ask"

Never make a demand. Frame it as: "I want to be at your school, but I am struggling with the $X price difference." You are inviting them to help you solve a problem.

The "Commitment" Hook

If they are your #1 choice, tell them! A promise to "deposit immediately if matched" is the most powerful leverage you have to close the deal.

The Scholarship Season Timeline

Offer Season

Receive initial merit offers. Do NOT negotiate yet.

Strategy Phase

Gather all competing offers. Compare COA (Cost of Attendance) using LawZee tools.

The Golden Month

The peak window for negotiation. Schools are monitoring their 'yield' goals.

The First Deposit

Deadline to commit. Leverage is highest just before this date.

Waitlist Movement

Unclaimed scholarship funds trickle down to waitlisted candidates.

The Reconsideration Email Template

Subject: Scholarship Reconsideration Request - [Your Name] - LSAC #[Number] Dear Director [Last Name] and the Financial Aid Committee, Thank you very much for my admission to [Target School Name] and for the generous $[Amount] merit scholarship offer. I am writing to sincerely request a reconsideration of my award. [Target School Name] remains my top choice due to your exceptional program in [Specialized Area] and the [Specific Clinic/Program]. However, as I finalize my plans, the financial aspect is a significant factor. I have received a merit offer of $[Amount] from [Peer School Name], which would make my total cost of attendance significantly lower. Because I have a sincere desire to join the [Target School Name] community, I wanted to share this information in hopes that [Target School Name] might be able to move closer to that offer. If [Target School Name] were able to increase my award to $[Amount], I would be in a position to withdraw my other applications and submit my seat deposit immediately. Thank you for your time and for your continued consideration of my application. Best regards, [Your Name] [Your Phone Number]

What NOT to Do (The Negotiator’s Blacklist)

Frequently Asked Questions

Can I negotiate if I don't have another offer?

Yes, but your leverage is much lower. Focus on 'changed financial circumstances' (e.g. job loss, medical bills) rather than 'market value.' Or, if your LSAT score went up, that is valid leverage even without another offer.

Do T14 schools (like Yale/Harvard/Stanford) negotiate?

Generally, no. These schools (and often Chicago/Penn) only offer 'Need-Based' aid. They don't give merit scholarships because they assume if you get in, you already want to go. You can only negotiate their 'Need' assessment if you have a compelling case for a recalculation.

Will asking for more money hurt my admission status?

Absolutely not. Schools expect negotiation. It shows you are financially literate and serious about your future. It will never result in an admission being revoked (unless you lie).

What if my peer offer is only $5k higher?

Still negotiate! $5k/year is $15k total. With interest, that's nearly $25k in lifetime savings. No amount is too small to request a match.

— Former Director of Financial Aid